Determine the ending balance of each of the following t-accounts – Determining the ending balance of T-accounts is a crucial aspect of accounting, providing a comprehensive snapshot of a company’s financial position at a specific point in time. This guide will delve into the intricacies of T-accounts, exploring the methods for calculating ending balances and their significance in financial reporting and analysis.

T-accounts, the fundamental building blocks of double-entry bookkeeping, serve as individual records of transactions for each account. Understanding how to determine their ending balances is essential for accurate financial record-keeping and ensuring the integrity of financial statements.

Introduction

In accounting, a T-account is a simple representation of an account that records transactions related to a specific asset, liability, equity, revenue, or expense. The ending balance of a T-account is the difference between the total debits and total credits recorded in the account.

Determining the ending balance of a T-account is essential for financial reporting and analysis. It provides a snapshot of the account’s activity over a specific period and helps in understanding the financial position of a business.

Methods for Determining Ending Balance

Method 1: Summing Debits and Credits

The most straightforward method for determining the ending balance of a T-account is to sum the total debits and credits recorded in the account.

- Sum the total debits recorded on the left side of the T-account.

- Sum the total credits recorded on the right side of the T-account.

- Subtract the total credits from the total debits to get the ending balance.

Method 2: Using the Trial Balance

A trial balance is a list of all accounts and their balances at a specific point in time. The ending balance of a T-account can be determined by locating the account in the trial balance and checking its balance.

Method 3: Using Closing Entries, Determine the ending balance of each of the following t-accounts

Closing entries are journal entries made at the end of an accounting period to transfer balances from temporary accounts (such as revenue and expense accounts) to permanent accounts (such as retained earnings). The ending balance of a T-account can be determined by considering the impact of closing entries on the account.

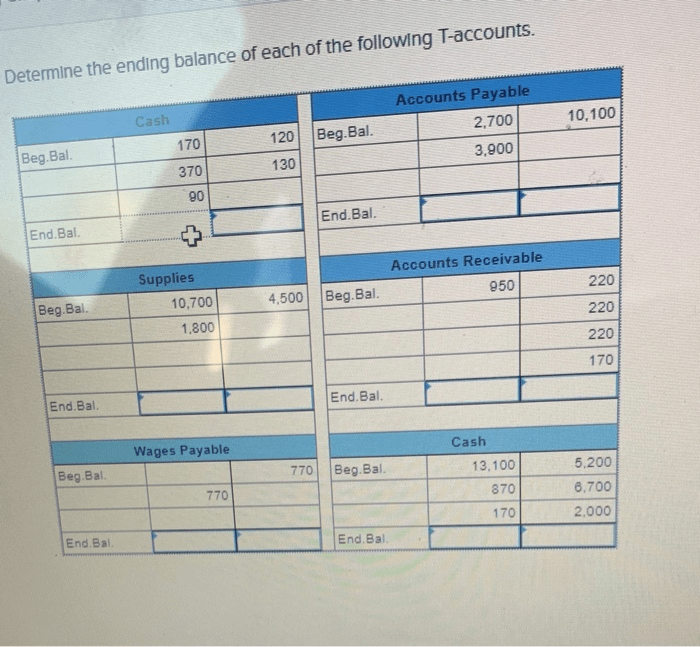

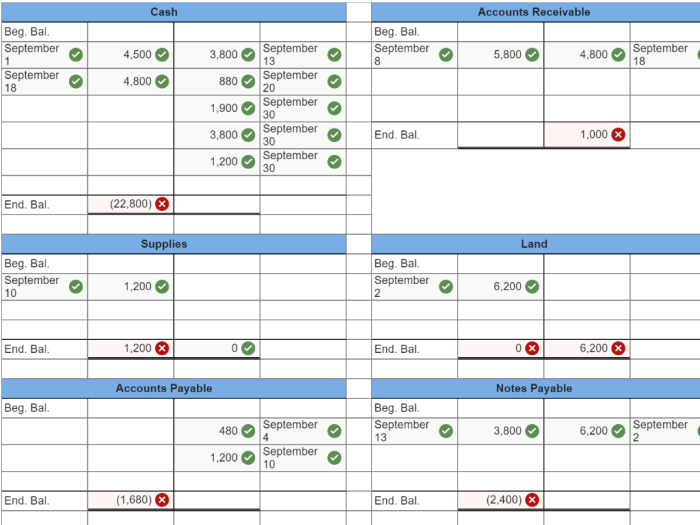

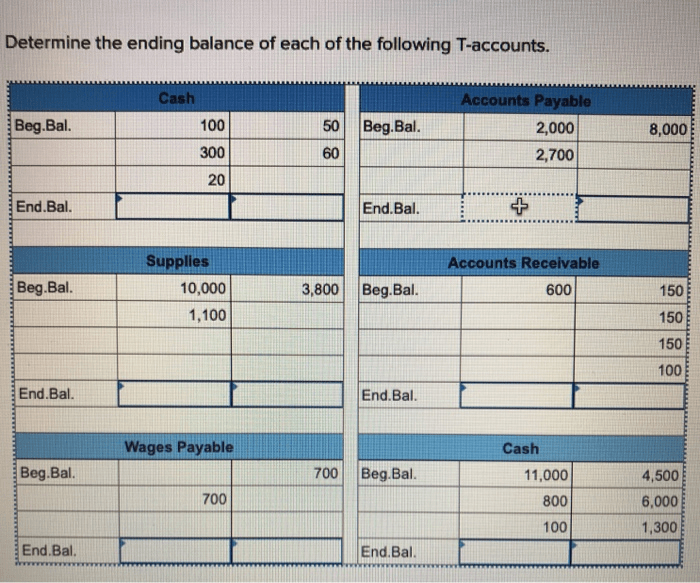

Examples of T-Accounts: Determine The Ending Balance Of Each Of The Following T-accounts

Example 1: Cash Account

Consider a T-account for a cash account with the following transactions:

| Date | Debit | Credit |

|---|---|---|

| Jan 1 | $5,000 | |

| Jan 10 | $2,000 | |

| Jan 15 | $1,000 | |

| Jan 20 | $3,000 |

Using the summing debits and credits method:

- Total debits: $6,000

- Total credits: $5,000

- Ending balance: $6,000 – $5,000 = $1,000

Example 2: Accounts Receivable Account

Consider a T-account for an accounts receivable account with the following transactions:

| Date | Debit | Credit |

|---|---|---|

| Feb 1 | $10,000 | |

| Feb 10 | $5,000 | |

| Feb 15 | $2,000 | |

| Feb 20 | $4,000 |

Using the summing debits and credits method:

- Total debits: $12,000

- Total credits: $9,000

- Ending balance: $12,000 – $9,000 = $3,000

Example 3: Inventory Account

Consider a T-account for an inventory account with the following transactions:

| Date | Debit | Credit |

|---|---|---|

| Mar 1 | $15,000 | |

| Mar 10 | $5,000 | |

| Mar 15 | $8,000 | |

| Mar 20 | $2,000 |

Using the summing debits and credits method:

- Total debits: $22,000

- Total credits: $8,000

- Ending balance: $22,000 – $8,000 = $14,000

Advanced Considerations

Handling Adjustments

Adjustments are made to T-accounts at the end of an accounting period to correct errors or to record transactions that have not yet been recorded. Adjustments can affect the ending balance of T-accounts.

Dealing with Errors

Errors in recording transactions can lead to incorrect ending balances in T-accounts. It is important to identify and correct errors promptly to ensure accurate financial reporting.

Special Cases

There may be special cases where the ending balance of a T-account cannot be determined using the methods discussed above. These cases may require additional analysis or consideration of specific accounting principles.

Conclusion

Determining the ending balance of T-accounts is an essential aspect of accounting. It provides a snapshot of the account’s activity over a specific period and helps in understanding the financial position of a business. The methods discussed in this provide a framework for calculating the ending balance of T-accounts accurately and efficiently.

FAQ Corner

What is the purpose of determining the ending balance of a T-account?

The ending balance of a T-account represents the net result of all transactions recorded in that account during a specific accounting period. It provides a snapshot of the account’s activity and is essential for preparing financial statements.

How can I calculate the ending balance of a T-account using the trial balance?

To calculate the ending balance using the trial balance, locate the account’s balance in the trial balance. The balance represents the ending balance of the account as of the date of the trial balance.

What is the role of closing entries in determining the ending balance of T-accounts?

Closing entries are journal entries made at the end of an accounting period to transfer temporary account balances to permanent accounts. These entries reset the temporary accounts to zero and ensure that the ending balances of permanent accounts reflect the company’s financial position at the end of the period.